In this article, we explain the difference between the many Brazilian inflation indexes, IPCA, IPGM, IPC and INCC and do some parallel to US equivalent indexes, when relevant.

In this article, we explain the difference between the many Brazilian inflation indexes, IPCA, IPGM, IPC and INCC and do some parallel to US equivalent indexes, when relevant.

Recent inflation information for brazil can be found here. Or find more about the perspective for the Brazilian Inflation and interest rate moving forward

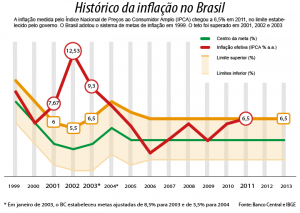

IPCA (Índice Nacional de Preços ao Consumidor Amplo) – Broad National Consumer Price Index: Equivalent to the CPI in the US. This is the official consumer inflation index. Federal government uses it to set inflation goals. Current target is 3.75% for 2021 and 3.5% for 2022 with a margin of 2% higher or lower. The IPCA range is targeted by the central bank when defining the interest rate, SELIC. The index is calculated by IBGE (federal geography and statistics institute) and tracks continuous and systematic variations in consumer prices for families with income of up to 40 minimum wages. Data is collected in the metropolitan areas of Belém, Recife, Fortaleza, Salvador, Belo Horizonte, Rio de Janeiro, São Paulo, Curitiba, Porto Alegre, Brasilia and Goiânia. Data is collected between the first and last day of the reference month, and is disclosed between the 8th and the 12th of the following month.

IGP-M (Índice Geral de Preços do Mercado) – General Index of Market Prices: Considered equivalent to the PPI – Producer Price Index, in the US. From Fundação Getúlio Vargas (a private entity), it was created to adjust some treasury securities and floating-rate bank deposits with maturities over one year. Later, it started to be used for corrections of contracts such as real estate rent and electricity. Disclosed at the end of the reference month since the collection is made from the 21st of the previous month and the 20th of the month to which it relates. It’s composed of of IPA – Wholesale Price Index (60%), IPC – Consumer Price Index (30%) and INCC – National Index of Construction Cost(10%). Every 10 days, it is disclosed a partial number known as IGP-10.

IPC – aka IPC-FIPE – (Índice de Preços ao Consumidor) CPI – Consumer Price Index: This is the inflation index for the city of São Paulo, largest city in Brazil. FIPE (a foundation linked to USP – University of São Paulo) measures the IPC based on a consumer with income between 1 and 20 minimum wages. The basket of products and services tracked is based on the POF – Household Budget Survey from IBGE, constantly updated. The survey is conducted between the first and last day of the reference month and published between the 10th and 20th of the following month. It is the most traditional cost of living indicator for the families in São Paulo and one of the oldest in Brazil, since January 1939.

INCC-DI (Índice Nacional de Custo de Construção, Disponibilidade Interna) – National Index of Construction Cost, Internal Availability: From Fundação Getúlio Vargas (private entity) in partnership with Caixa Economica Federal (public company), measures the cost of new housing in 18 cities: Aracaju, Belem, Belo Horizonte, Brasilia, Campo Grande, Curitiba, Florianópolis, Fortaleza, Goiânia, João Pessoa, Maceio, Manaus, Porto Alegre, Recife, Rio de Janeiro, Salvador, Sao Paulo and Vitoria. This is one of three items that comprise the IGP – General Price Index, with 10% weight. It is measured between the first and last day of the month and released about 20 days later. There is another number (INCC-M), calculated between day 21 of the previous month and the 20th of the month in reference for the composition of the IGP-M.

Read More

Recent inflation information for brazil

Perspective for the Brazilian Inflation and interest rate moving forward

Leave a Reply