Everything you need to know about Brazil investing

-

EcoRodovias (ECOR3) Long-Term Investment Analysis

Business Overview and Concession Portfolio EcoRodovias Infraestrutura e Logística S.A. is one of Brazil’s largest toll road operators. As of 2025, the company operates 12 highway concessions spanning over 4,800 km across 8 Brazilian states . These toll roads connect key industrial, agricultural, and port regions, making EcoRodovias a critical player in Brazil’s logistics network.…

-

Comprehensive Investment Analysis: Ânima Holding (ANIM3)

Company Overview and Business Model Ânima Holding S.A. (B3: ANIM3) is one of Brazil’s largest private higher education groups, serving roughly 385,000 students across 18 higher education institutions nationwide . Founded in 2003 and listed on the Novo Mercado segment of B3 since 2013 (indicating the highest level of corporate governance) , Ânima’s mission is…

-

Raízen (RAIZ4) Long-Term Investment Analysis for Foreign Investors

Business Overview and Segmentation Raízen S.A. (RAIZ4) is a leading integrated energy company in Brazil, operating across multiple segments of the fuel and renewable energy value chain. Formed as a joint venture between Brazilian conglomerate Cosan and global oil major Shell, Raízen has grown into one of the world’s largest sugarcane processors and ethanol producers…

-

Hypera Pharma (HYPE3/ HYPMY) – Long-Term Investment Analysis

Company Overview and Market Position Hypera Pharma (HYPE3) is one of Brazil’s largest and most diversified pharmaceutical companies, with operations spanning all major segments of the retail pharma market . Founded in 2001 as Hypermarcas (renamed Hypera Pharma in 2017), the company transitioned from a consumer goods conglomerate to a pure-play pharma leader . Today,…

-

Itaú Unibanco (ITUB4/ADR ITUB) and Itaúsa (ITSA4) – Comprehensive Long-Term Investment Analysis

Itaú Unibanco is Brazil’s leading private bank, known for strong profitability and consistent dividends, making it attractive for investors. This analysis presents Itaú’s business model, financial performance, competitive advantages, dividend policies, and growth potential. It contrasts investing directly in Itaú with investing through its holding company, Itaúsa, highlighting unique benefits and risks associated with each.

-

Banco do Brasil (BBAS3/ BDORY) – Long-Term Investment Analysis

Banco do Brasil (BDORY), Brazil’s oldest bank, offers strong profitability and high dividend yields amid a competitive landscape, but faces specific risks tied to agribusiness and government influence.

-

Deep Dive Analysis: GCRA11 Brazil Agribusiness Credit Fund

Galapagos Recebíveis do Agronegócio (ticker GCRA11) is a Brazilian FIAGRO (agribusiness real estate credit fund) launched in August 2021

-

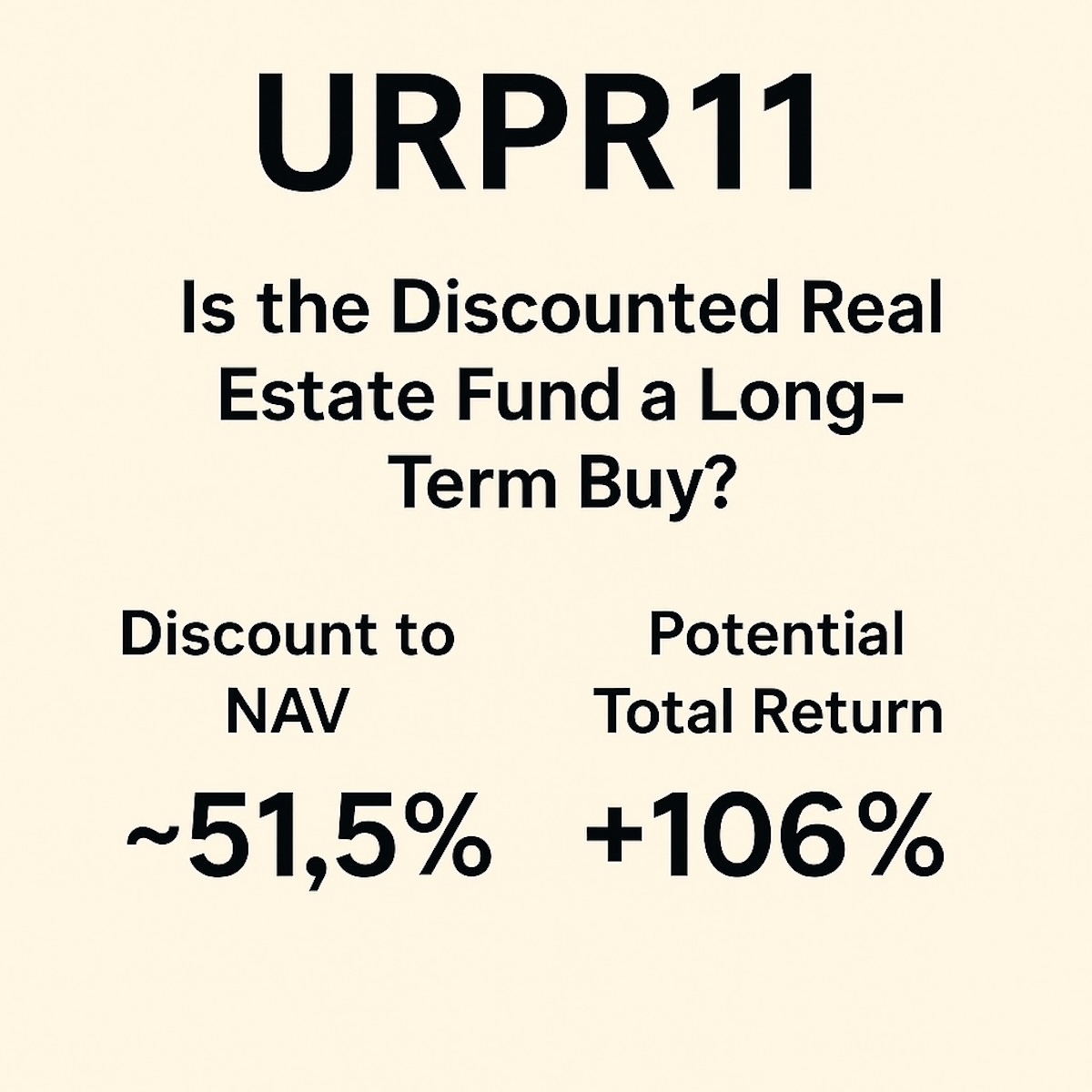

URPR11: Is the Discounted Brazilian Real Estate Fund a Long-Term Buy?

Ticker: URPR11 (Urca Prime Renda FII) Current price: ~R$48.70 Net Asset Value (NAV): R$100.50 Discount to NAV: ~51.5% Distribution Yield (last 12 months): Significantly reduced, recovering slowly Sector: Real estate credit (CRI-backed development projects) 1. What Happened to URPR11? URPR11 was once a high-yield real estate credit fund focused on structured debt for real estate…

-

Petrobras (PETR3, PETR4, PBR): Full 2025 Financial Analysis of Brazil’s Energy Giant

Petrobras (PBR ADR, PETR3, PETR4) is Latin America’s largest energy company and one of the world’s biggest oil producers. The company plays a vital role in Brazil’s economy, not only as a state-controlled enterprise but also as a major global exporter of high-quality crude. Petrobras today operates with world-class upstream assets, growing dividend payouts, and…

-

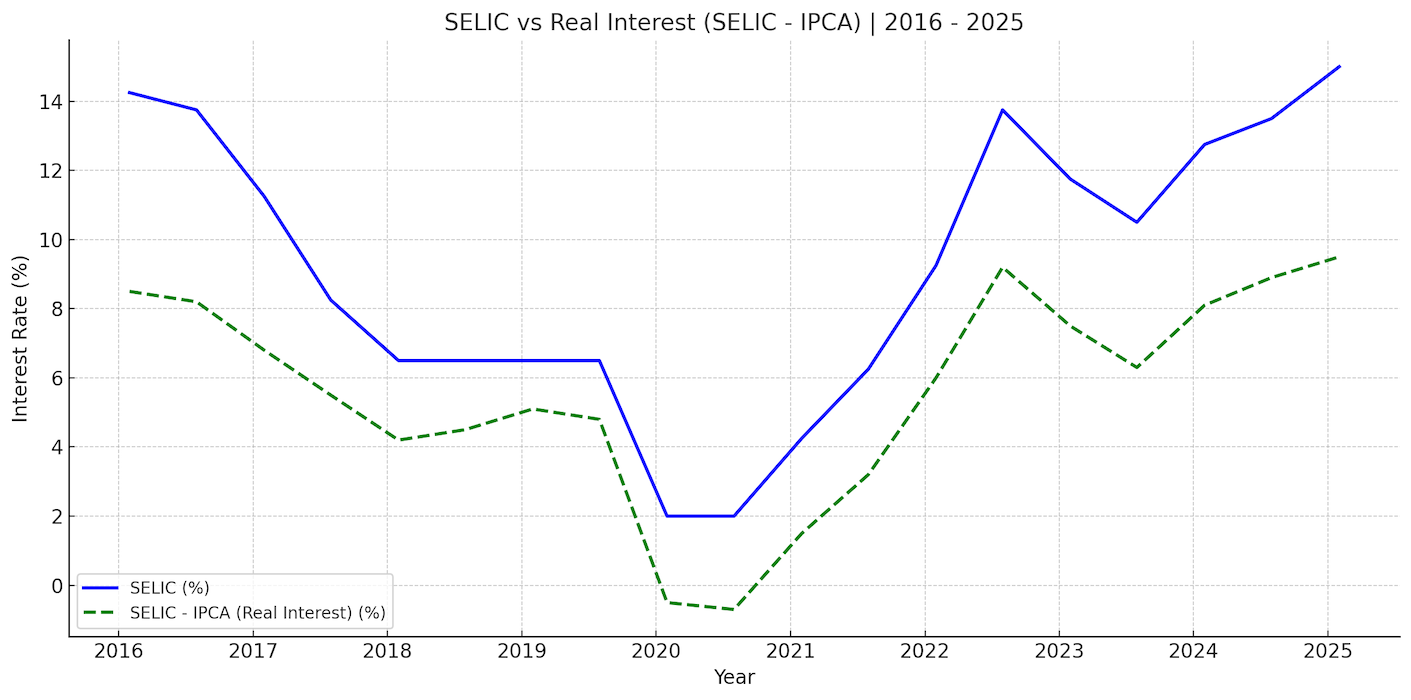

Brazil’s Central Bank Rate Hike to 15%: What It Means for Investors

Brazil’s Central Bank (Banco Central do Brasil, or BCB) raised the Selic interest rate by 25 basis points to 15% on June 18, 2025. This is now the highest interest rate in Brazil since 2006. The decision, made unanimously by the Monetary Policy Committee (Copom), signals not only the end of the current tightening cycle…

Got any recommendations or questions?