Brazil’s Central Bank (Banco Central do Brasil, or BCB) raised the Selic interest rate by 25 basis points to 15% on June 18, 2025. This is now the highest interest rate in Brazil since 2006.

The decision, made unanimously by the Monetary Policy Committee (Copom), signals not only the end of the current tightening cycle but also a clear message: rates will stay elevated for a “prolonged period” to ensure inflation returns to target.

📈 Why Did Brazil Raise Interest Rates Again?

The Central Bank has now raised rates by a total of 450 basis points since September 2024, moving the Selic from 10.5% to 15%.

The main reasons cited were:

- Persistent inflation pressures, especially in services.

- Unanchored inflation expectations for 2025 and 2026, which remain above the official 3% inflation target.

- A tight labor market and resilient domestic demand.

- A more challenging external environment, including the impact of U.S. interest rates and new global trade tariffs.

🔍 Key Insights from the Copom Statement

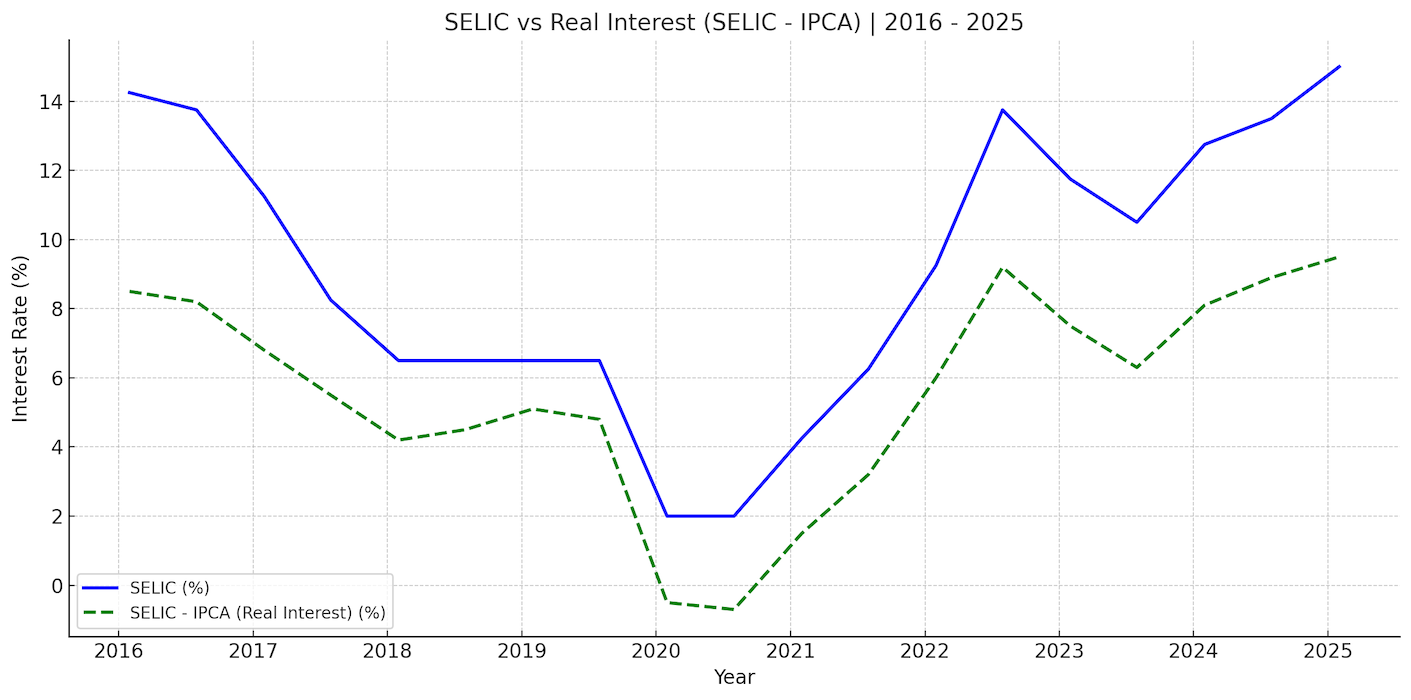

- The Copom acknowledged that the Selic rate is now deeply contractionary, with a real interest rate (Selic minus inflation expectations) of 9.5%, well above the Central Bank’s estimate of a neutral rate (~5%).

- The statement carried a hawkish tone, emphasizing the need to maintain rates at a restrictive level for a “substantially extended period”.

- The committee made clear that further hikes are possible if the economic outlook worsens, particularly regarding inflation.

- Both upside and downside risks to inflation were highlighted, but the Copom stopped short of describing them as asymmetric — a subtle shift from previous meetings where upside risks dominated.

🏦 Is This the End of the Hiking Cycle?

Most analysts, including those at Galapagos Capital, believe this is the final hike of the cycle. However, the Central Bank will remain data-dependent and ready to act again if inflation fails to converge.

“The effects of monetary policy will become more visible in the second half of 2025, with slowing activity and cooling inflation expected to help re-anchor expectations,” said Tatiana Pinheiro, Chief Economist at Galapagos Capital.

The Central Bank’s own projection for 2026 inflation is 3.6%, still above the 3% target, suggesting the battle isn’t over yet.

📊 How High Is 15% Historically?

- This is the highest Selic rate since 2006, when Brazil was battling double-digit inflation and commodity-driven overheating.

- The current real interest rate (9.5%) is one of the highest in the world, providing very strong carry for local currency investments but also raising concerns about growth.

🗺️ Outlook: When Will Rates Start Falling?

Analysts expect:

- The first rate cuts to begin in December 2025, starting with a 50 bps reduction.

- A gradual path toward a Selic of 10.5% by July 2026, assuming inflation trends improve.

Institutions such as BTG Pactual and XP Investimentos echoed similar views, though some warn that persistent fiscal concerns could delay the easing cycle.

🌍 Global Context Matters

Brazil’s Central Bank is not alone in tightening. Globally:

- U.S. Federal Reserve rates remain high, with cuts delayed into 2026 amid sticky services inflation.

- Emerging markets are feeling the impact of U.S. tariffs on Chinese goods, which spill over into trade partners like Brazil.

- Commodity prices have softened slightly, but oil remains elevated, keeping some inflation pressure alive.

💡 What This Means for Investors

✅ For Fixed Income:

- Brazil remains one of the most attractive carry trades in the world.

- Local bonds are offering real yields above 9%, highly appealing to global investors.

✅ For Equities:

- Negative for rate-sensitive sectors like real estate, retail, and utilities.

- Positive for exporters and commodities, as a stronger real rate keeps the currency stable.

✅ For Currency (BRL):

- High interest rates support the Brazilian real (BRL), making it one of the most resilient emerging market currencies.

📌 Bottom Line

The Selic rate at 15% signals a clear message: Brazil’s Central Bank is prioritizing inflation control over growth.

For investors, this means:

- Very attractive fixed income opportunities in Brazil.

- A cautious approach for equities tied to domestic consumption.

- A stable currency supported by the highest real rates among major emerging markets.

The big question ahead is whether inflation begins to show decisive signs of convergence in the second half of 2025 — only then will the path toward interest rate cuts become clearer.

📬 Follow Easy Brazil Investing for more updates on Brazil’s economy, markets, and investment opportunities — all in English. Or follow us on X

Leave a Reply