Everything you need to know about Brazil investing

-

Hypera Pharma (HYPE3/ HYPMY) – Long-Term Investment Analysis

Company Overview and Market Position Hypera Pharma (HYPE3) is one of Brazil’s largest and most diversified pharmaceutical companies, with operations spanning all major segments of the retail pharma market . Founded in 2001 as Hypermarcas (renamed Hypera Pharma in 2017), the company transitioned from a consumer goods conglomerate to a pure-play pharma leader . Today,…

-

Itaú Unibanco (ITUB4/ADR ITUB) and Itaúsa (ITSA4) – Comprehensive Long-Term Investment Analysis

Itaú Unibanco is Brazil’s leading private bank, known for strong profitability and consistent dividends, making it attractive for investors. This analysis presents Itaú’s business model, financial performance, competitive advantages, dividend policies, and growth potential. It contrasts investing directly in Itaú with investing through its holding company, Itaúsa, highlighting unique benefits and risks associated with each.

-

Banco do Brasil (BBAS3/ BDORY) – Long-Term Investment Analysis

Banco do Brasil (BDORY), Brazil’s oldest bank, offers strong profitability and high dividend yields amid a competitive landscape, but faces specific risks tied to agribusiness and government influence.

-

Deep Dive Analysis: GCRA11 Brazil Agribusiness Credit Fund

Galapagos Recebíveis do Agronegócio (ticker GCRA11) is a Brazilian FIAGRO (agribusiness real estate credit fund) launched in August 2021

-

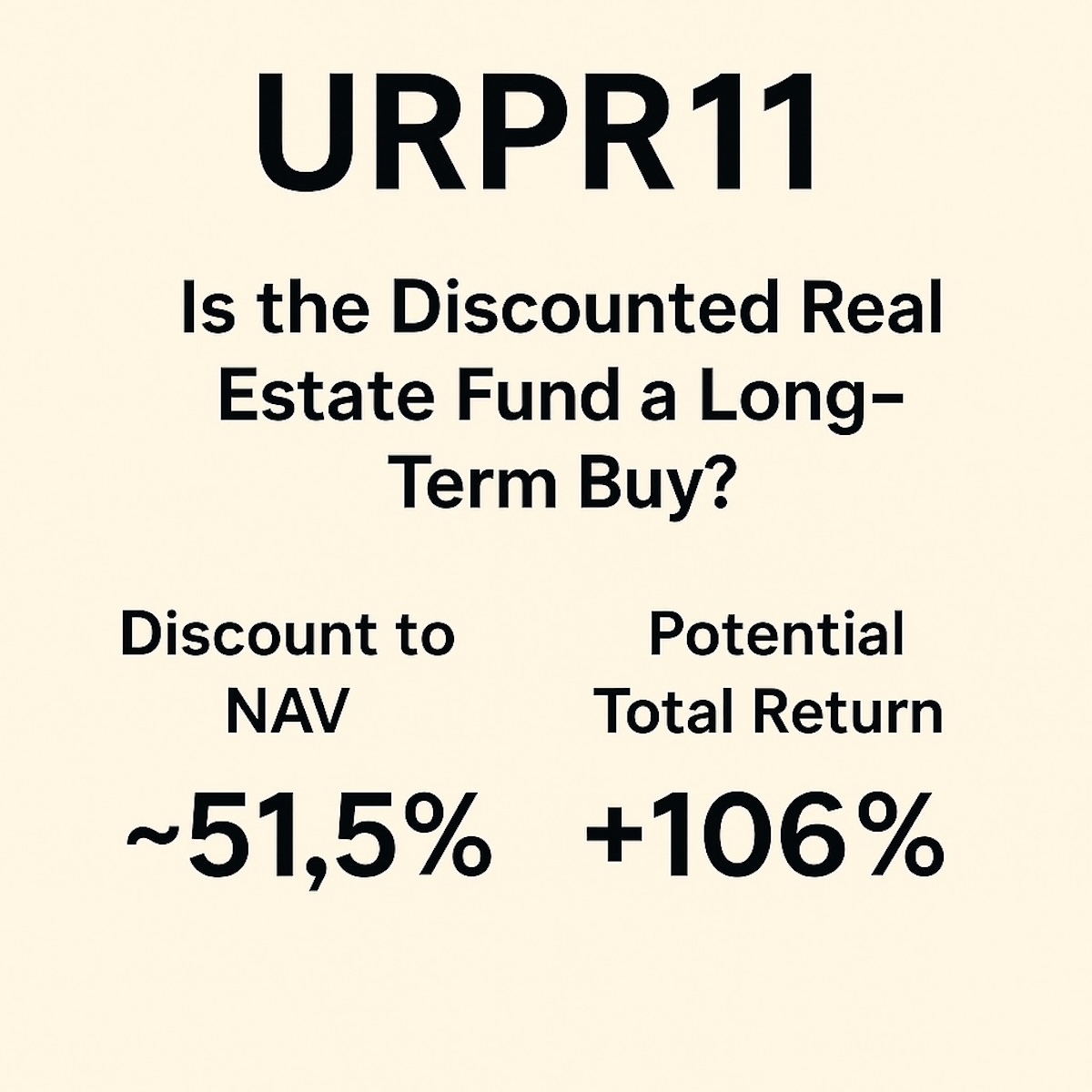

URPR11: Is the Discounted Brazilian Real Estate Fund a Long-Term Buy?

Ticker: URPR11 (Urca Prime Renda FII) Current price: ~R$48.70 Net Asset Value (NAV): R$100.50 Discount to NAV: ~51.5% Distribution Yield (last 12 months): Significantly reduced, recovering slowly Sector: Real estate credit (CRI-backed development projects) 1. What Happened to URPR11? URPR11 was once a high-yield real estate credit fund focused on structured debt for real estate…

-

Petrobras (PETR3, PETR4, PBR): Full 2025 Financial Analysis of Brazil’s Energy Giant

Petrobras (PBR ADR, PETR3, PETR4) is Latin America’s largest energy company and one of the world’s biggest oil producers. The company plays a vital role in Brazil’s economy, not only as a state-controlled enterprise but also as a major global exporter of high-quality crude. Petrobras today operates with world-class upstream assets, growing dividend payouts, and…

-

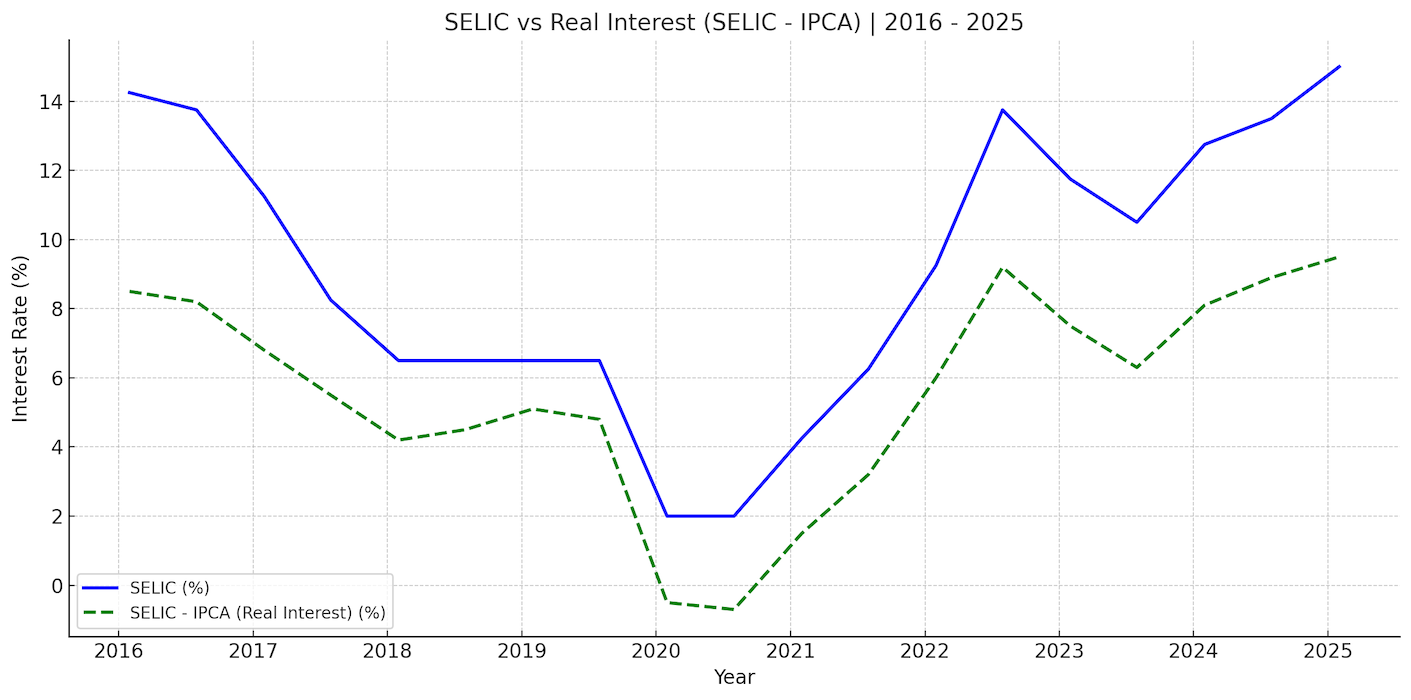

Brazil’s Central Bank Rate Hike to 15%: What It Means for Investors

Brazil’s Central Bank (Banco Central do Brasil, or BCB) raised the Selic interest rate by 25 basis points to 15% on June 18, 2025. This is now the highest interest rate in Brazil since 2006. The decision, made unanimously by the Monetary Policy Committee (Copom), signals not only the end of the current tightening cycle…

-

Vale (VALE3 / VALE): 2025 Financial Analysis of Brazil’s Mining Titan

Vale S.A. is a leading force in the global mining industry. Known primarily for iron ore, it is expanding its presence in base metals, used in energy transition

-

JHSF (JHSF3) Stock Analysis: High-Yield Exposure to Brazil’s Luxury Ecosystem

JHSF Participações S.A. (B3: JHSF3) is unlike any other real estate company in Brazil. It offers integrated exposure to luxury real estate, high-end shopping centers, boutique hotels and restaurants, and private aviation infrastructure. The company’s long-term strategy to build a vertically integrated lifestyle platform is now translating into record results, recurring cash flows, and a…

-

📈Ibovespa June 11, 2025

📈 Ibovespa at a Glance Top Gainers (Stocks with Best Daily Performance) Top Losers 🔍 Market Commentary & Technical Analysis Mini contracts (WIN, minidollar, mini-BTC): Summary

Got any recommendations or questions?