Tag: commodities

-

Klabin (KLBN11) – Comprehensive Analysis for Foreign Investors

Klabin S.A. is Brazil’s largest producer and exporter of packaging paper and paper packaging solutions, with a diversified business spanning pulp, paper, and converted packaging products . The company operates an integrated model – it produces market pulp (short-fiber, long-fiber and fluff), converts part of that pulp into paper (kraftliner containerboard and coated board for…

-

Fundo Imobiliário Riza Terrax (RZTR11) – Comprehensive Analysis for Foreign Investors

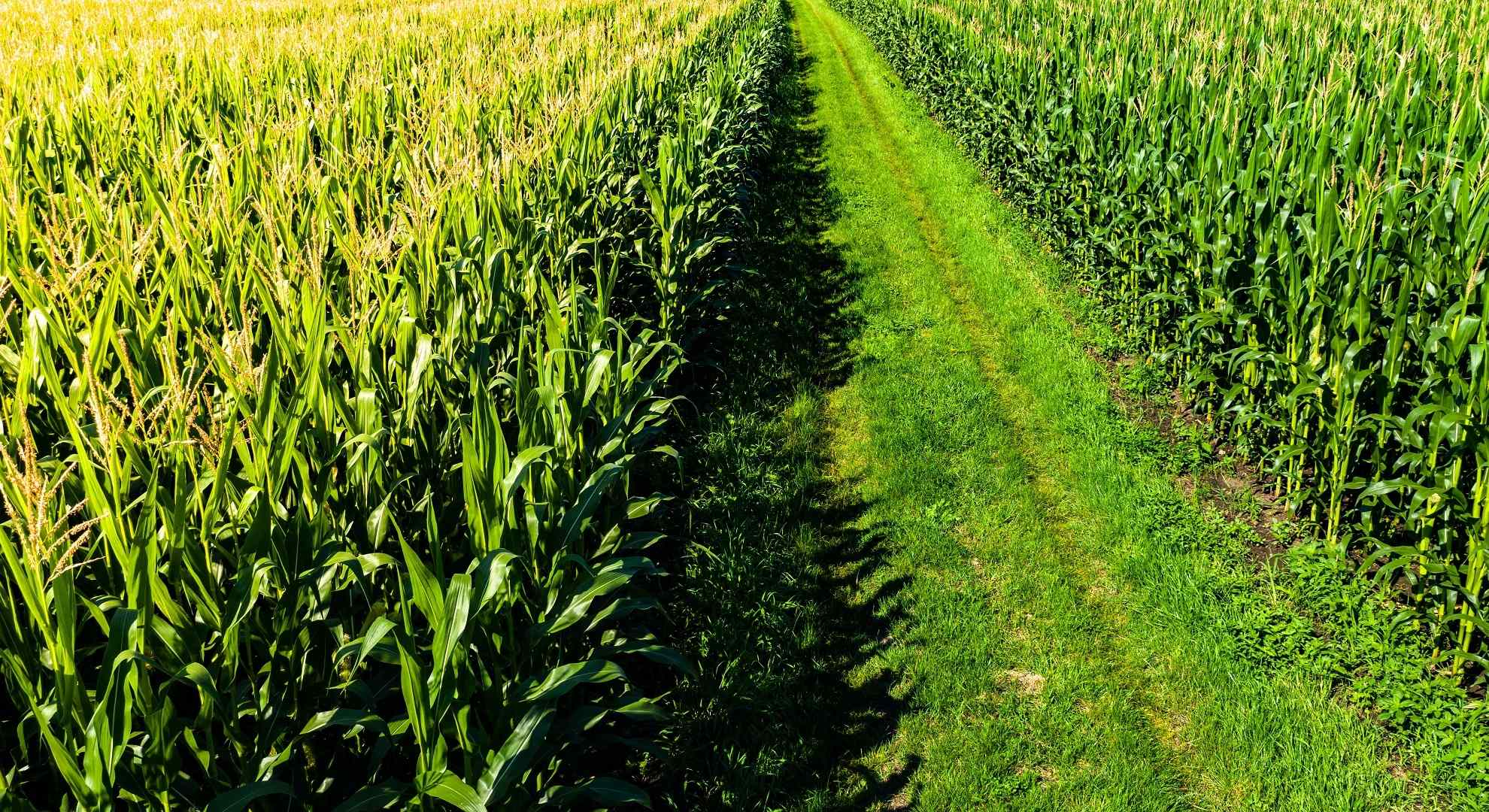

Overview of Riza Terrax (RZTR11) RZTR11 – Riza Terrax is a Brazilian Real Estate Investment Fund (FII) focused on the agribusiness sector. Launched in October 2020, the fund acquires productive rural properties (farmland) and leases them to agricultural operators . This “buy-and-lease” model provides investors exposure to Brazilian farmland – an asset class with historically…

-

Raízen (RAIZ4) Long-Term Investment Analysis for Foreign Investors

Business Overview and Segmentation Raízen S.A. (RAIZ4) is a leading integrated energy company in Brazil, operating across multiple segments of the fuel and renewable energy value chain. Formed as a joint venture between Brazilian conglomerate Cosan and global oil major Shell, Raízen has grown into one of the world’s largest sugarcane processors and ethanol producers…

-

Deep Dive Analysis: GCRA11 Brazil Agribusiness Credit Fund

Galapagos Recebíveis do Agronegócio (ticker GCRA11) is a Brazilian FIAGRO (agribusiness real estate credit fund) launched in August 2021

-

Petrobras (PETR3, PETR4, PBR): Full 2025 Financial Analysis of Brazil’s Energy Giant

Petrobras (PBR ADR, PETR3, PETR4) is Latin America’s largest energy company and one of the world’s biggest oil producers. The company plays a vital role in Brazil’s economy, not only as a state-controlled enterprise but also as a major global exporter of high-quality crude. Petrobras today operates with world-class upstream assets, growing dividend payouts, and…

-

Vale (VALE3 / VALE): 2025 Financial Analysis of Brazil’s Mining Titan

Vale S.A. is a leading force in the global mining industry. Known primarily for iron ore, it is expanding its presence in base metals, used in energy transition

-

Trump Effect? Experts begin to see the first impacts of the American election on the markets

In his last term, the Republican increased protectionism and generated a trade war with China. Last Tuesday (16th), financial market experts pointed out that the American elections may have had an impact on the market. The overwhelming victory of former President Donald Trump in one of the first Republican Party primaries in Iowa is said…

-

Ibovespa closed with a 1.46% increase on Monday and rose 3.27% in July. What drove the index’s growth?

The index registered its fourth consecutive month of gains, primarily driven by commodities-related stocks this time. In July, the Ibovespa closed with a 3.27% increase, marking its fourth consecutive monthly gain. On the last trading day of the month (July 31st), the main index of the Brazilian stock exchange rose, driven by commodity exporters and…

-

Petrobras (PETR4) announces a new dividend policy and will pay 45% of free cash flow to shareholders

The new policy allows for share buybacks, which, when executed, will be carried out through an approved structured program by the Council. The Board of Directors of Petrobras (PETR3; PETR4) announced on Friday (28th) that it has approved its new dividend policy, which also allows for share buybacks, according to a document sent to the…

-

Vale (VALE3) announces the sale of 13% of its basic metals business for US$ 3.4 billion

The transaction valued the mining company’s metals division at US$ 26.0 billion On Thursday (27th), Vale (VALE3) announced that it has signed a binding agreement with Manara Minerals and the American asset manager Engine No. 1 to sell a 13% stake in its basic metals unit (VBM) for the amount of US$ 3.4 billion. The…